Build-to-rent or BTR is a purpose-built rental housing scheme within London’s thriving real estate ecosystem, wherein large-scale developments are constructed specifically for the rental market. However, to fully grasp the benefits of this growing investment trend, we need to know its origins. The UK embraced BTR for the first time in 2012, as it was a response by the government to the Montague Review that year, which identified significant potential for investment in developing new homes exclusively for the rental market.

In addition to being a new avenue for investment, the initiative was welcomed by several local authorities in London as a means to support their efforts in dealing with the shortages in the local housing market. London’s rental market previously focused solely on the private rented sector (PRS), where properties are owned by private landlords and leased to tenants, also known as the buy-to-let (BTL) sector. However, BTR introduced a paradigm shift as these new schemes were owned by institutional investors and property companies. They offered tenants professionally managed residences and investors a way of earning more predictable and reliable rental yields due to the scale and management of these developments.

The rise in popularity of BTR

From an idea by the government in 2012 to an industry of over 100,000 completed homes at the end of 2023, BTR has come a long way and supported the rationale of becoming an indispensable source of housing in the UK. According to the British Property Foundation’s (BPF) latest quarterly report in Q4 2023, the number of BTR homes complete, under construction, or in planning stands at just under 267,000, marking a 5% annual increase from Q4 2022. With 46,747 units ready in London, BTR completions in the UK Capital increased by 12%.

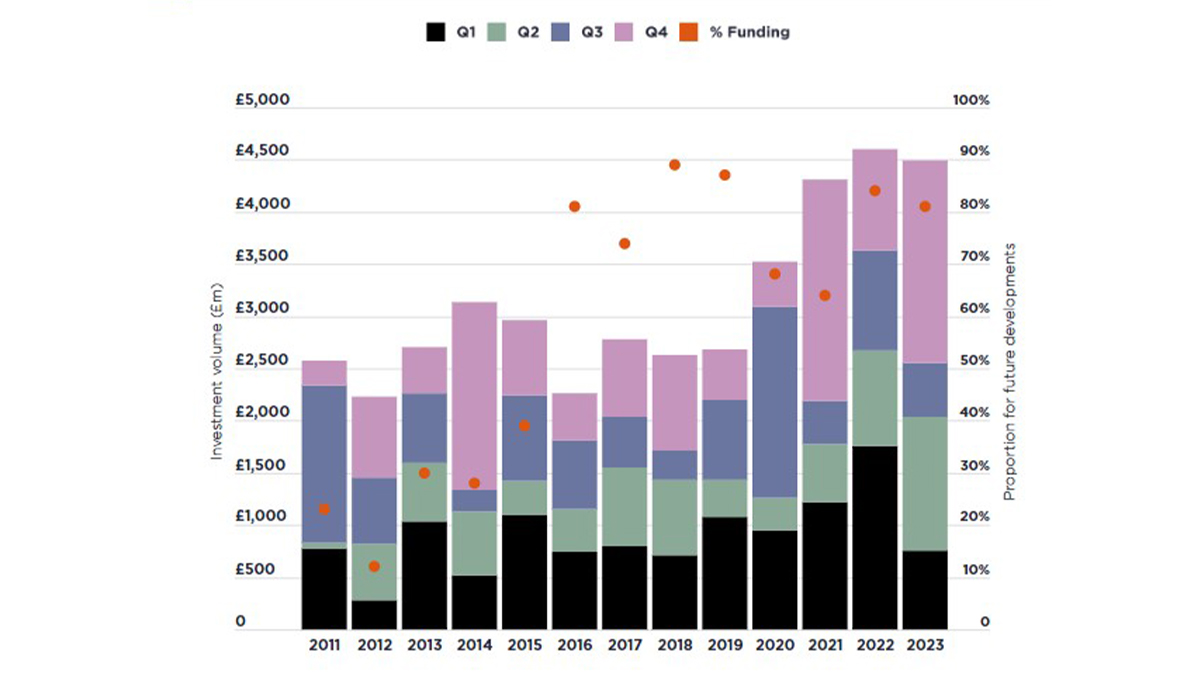

While 2023 witnessed a minor blip of -2% in investment compared to 2022, the BTR sector still saw massive investments worth £4.5 billion (see chart 1), as for the first time, the number of completed units overtook the number of starts. The sector also showed its resilience by recording its second-highest investment year after navigating the macroeconomic limitations of elevated debt costs and continued material and labour inflation.

Chart 1: Investments in BTR

Source: Savills Research

Current market overview

If we look at the geographic distribution of BTR developments completed across the UK at present, London’s total of 479 far outpaces the next five cities put together. These numbers reflect the high housing demand in the capital, which has led it to capture almost 85% of the total completed BTR share across the country. You can read our previous article on the current BTR landscape for a more in-depth analysis.

| London | Manchester | Sheffield | Bristol | Liverpool | Leicester |

| 479 | 141 | 37 | 25 | 21 | 10 |

Factors driving BTR growth

The meteoric rise of the BTR sector can be linked to three pillars of growth. The first pillar focuses on economic factors, such as elevated mortgage rates and the disparity between income and house prices. According to the Office of National Statistics (ONS), over 80% of London neighbourhoods have an affordability ratio of above 12, meaning the price of an average house is 12 times the annual salary of residents. An end to the Help to Buy Scheme in 2023 further deterred first-home buyers who couldn’t avail of the 20% equity loan from the government to cover deposit costs.

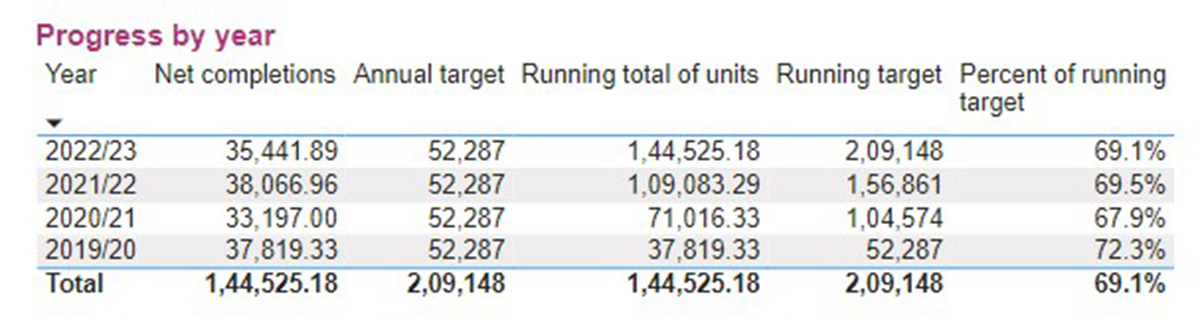

The second pillar of growth refers to the demographic trends, wherein the population of London has steadily climbed by over 1% a year since 2019, likely to close in on 10 million this year. To meet the housing needs of the expanding city, the Mayor’s Office set a target of 52,287 new homes annually in its ongoing 10-year plan, for which the current completion rate falls short at 69.1% of what it should be to meet the decade-long target.

Source: london.gov.uk

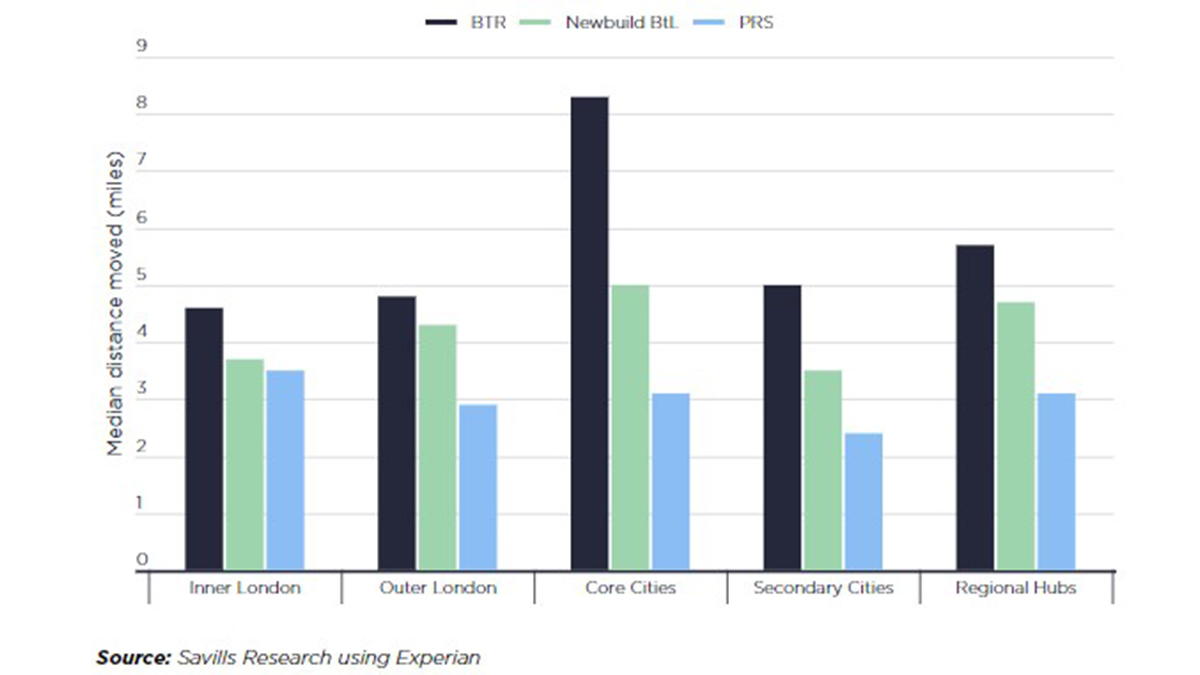

Finally, BTR has proved to perform better than the wider PRS and BTL sectors on several lifestyle parameters, such as rental stability, build-quality of houses, energy efficiency and standard of accommodation. The availability of more shared amenities and resident facilities, such as 24-hour customer service via dedicated apps and social events that foster community spirit, have added to the appeal of BTR for tenants. This demand for BTR over other forms of rental living is reflected by the distance dwellers are willing to move. While the median distance of movers to BTR in the UK is 5.8 miles, new-build BTLs are 39% less at 4.2 miles and almost half for the PRS at 3 miles. (see chart 2)

Chart 2

How investors have benefited from BTR?

While BTR has proved to be a silver lining for London’s housing shortage, investors have capitalised on the high levels of rental growth. With a close to 7% increase in London rents during Q1 2024, investor sentiment in the private rental sector is buoyant. As a purpose-built rental solution, investors can rely on high occupancy rates that drive consistent rental income. Professionally managed properties that are tailored to resident needs often command premium rents with the potential for future growth. According to a report by JLL last year, strategically placed BTRs in sought-after corporate neighbourhoods like Canary Wharf and Nine Elms provided up to 38% better yields than the local PRS. Additionally, as the BTR market matures, investors benefit from potential capital appreciation on their underlying assets.

Future outlook & emerging trends for BTR

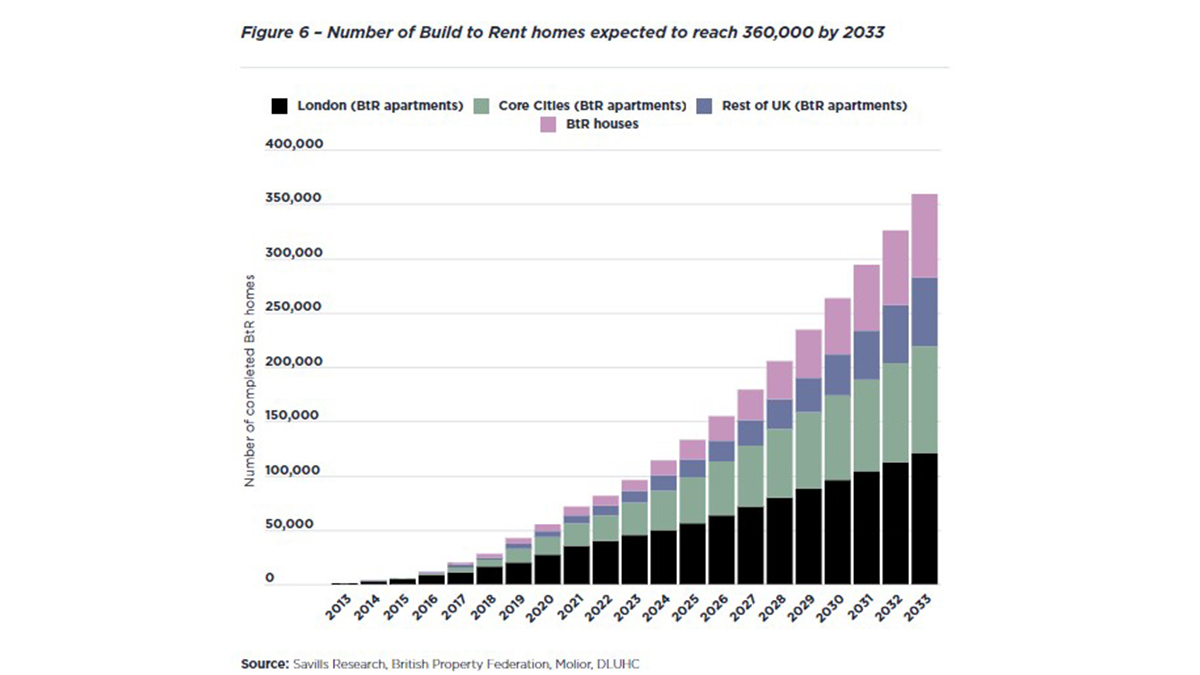

By combining the short-term planning pipeline and projected growth rates of the sector, we can expect a long-term supply pipeline of up to 360,000 new BTR homes by 2033. (see chart 3)

Chart 3

Source: Savills Research

However, it is not just the volume of residences that developers need to focus on, as residents are vocal about the quality of homes, they choose to reside in. Community is at the heart of BTR, and young renters below the age of 35 years make up almost 80% of the total tenancy, according to a recent study by the BPF. These younger Gen Z and millennial renters are environmentally more conscious and prioritise people first design and building practices within their living spaces. Subsequently, the seven principles of the BTR Code of Practice laid down by the Association of Rental Living (ARL) require developers within the sector to adopt a people-first approach across their operations and supply chains.

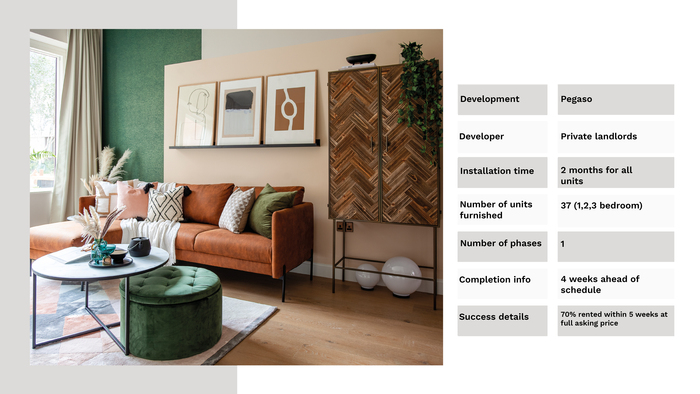

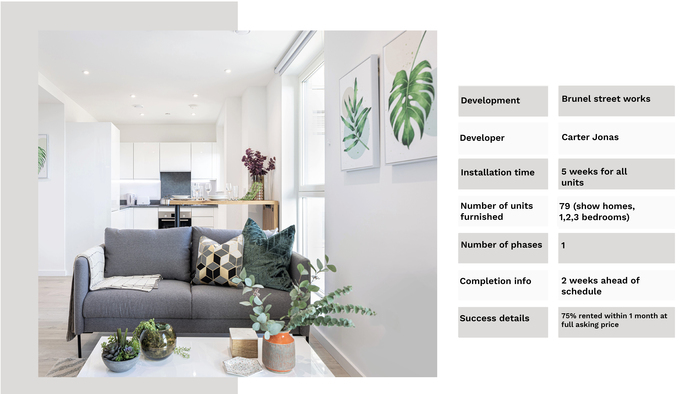

At InStyle Direct, our successful collaboration with several leading developers and investors over the last two decades has led us to introduce a suite of furnishing and interior design solutions for BTR properties. Our ethical sourcing practices, robust ESG strategy and commitment to people-first design have placed us at the forefront of servicing the sector’s interior and furnishing needs.

Our efforts to service and improve the quality of BTR residences have been appreciated by residents, as 85% of all properties sustainably furnished by us are let within a week of completion.